First Time Home Buyer 401k Withdrawal 2024 Irs Limits – If you’re one of the growing number of independent contractors, retirement planning can sometimes seem daunting given the lack of access to a traditional retirement account like a 401 (k). Fortunately . When combined with employer contributions, a maximum of $69,000 can be directed to your workplace retirement plans in 2024 (plus the $7,500 catch-up contribution for those age 50 and older). Note that .

First Time Home Buyer 401k Withdrawal 2024 Irs Limits

Source : smartasset.com401k Contribution Limits For 2024

Source : thecollegeinvestor.comIRS Unveils Increased 2024 IRA Contribution Limits

Source : www.theentrustgroup.com6 Things to Know About Roth 401(k) Withdrawals | The Motley Fool

Source : www.fool.comWhat’s New for Retirement Saving for 2024? | SEIA | Signature

Source : www.seia.comIRA Contribution Limits And Income Limits For 2023 And 2024

Source : thecollegeinvestor.comIRS: 401(k), IRA contribution limits for 2024

Source : www.cnbc.com401(K) contribution limits are set to rise in 2024 here’s how to

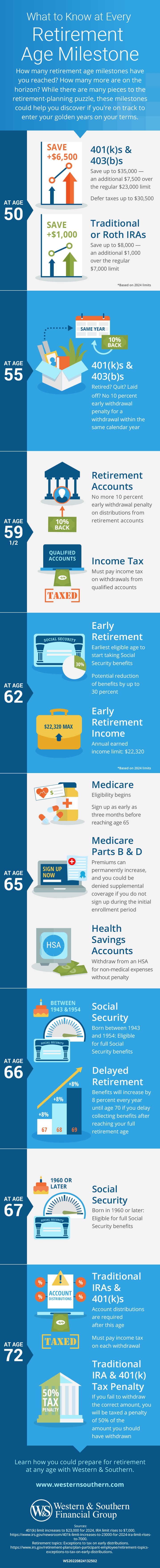

Source : www.dailymail.co.ukPlanning for Retirement at Every Retirement Age Milestone

Source : www.westernsouthern.comRoth IRA: Benefits, Rules, and Contribution Limits 2024

Source : districtcapitalmanagement.comFirst Time Home Buyer 401k Withdrawal 2024 Irs Limits Save More in Your 401(k) or IRA in 2024: IRS Announces New : A Registered Retirement tax consequences through the Home Buyers’ Plan (HBP), if they plan to buy a home, and Lifelong Learning Plan (LLP), if they plan to pursue education, so long as they pay . ISAs to help first-time buyers save a deposit are becoming increasingly ineffective because of outdated restrictions and rising house prices, experts have warned .

]]>